As the price of crude oil rises, energy companies are beginning to bank on sales growth to boost shareholder returns. Conversations with executives reveal that they are largely focusing on new technology to deliver product innovation and lower prices.

These are admirable goals, but the real focus should be on customer satisfaction. For one thing, satisfied customers are more likely to generate positive word-of-mouth, helping sales growth through recommendations and referrals.

Meanwhile, dissatisfied customers can be expected to spread their complaints throughout their social and business networks, inhibiting growth by sowing doubt and stealing the spotlight from customers who praise the company.

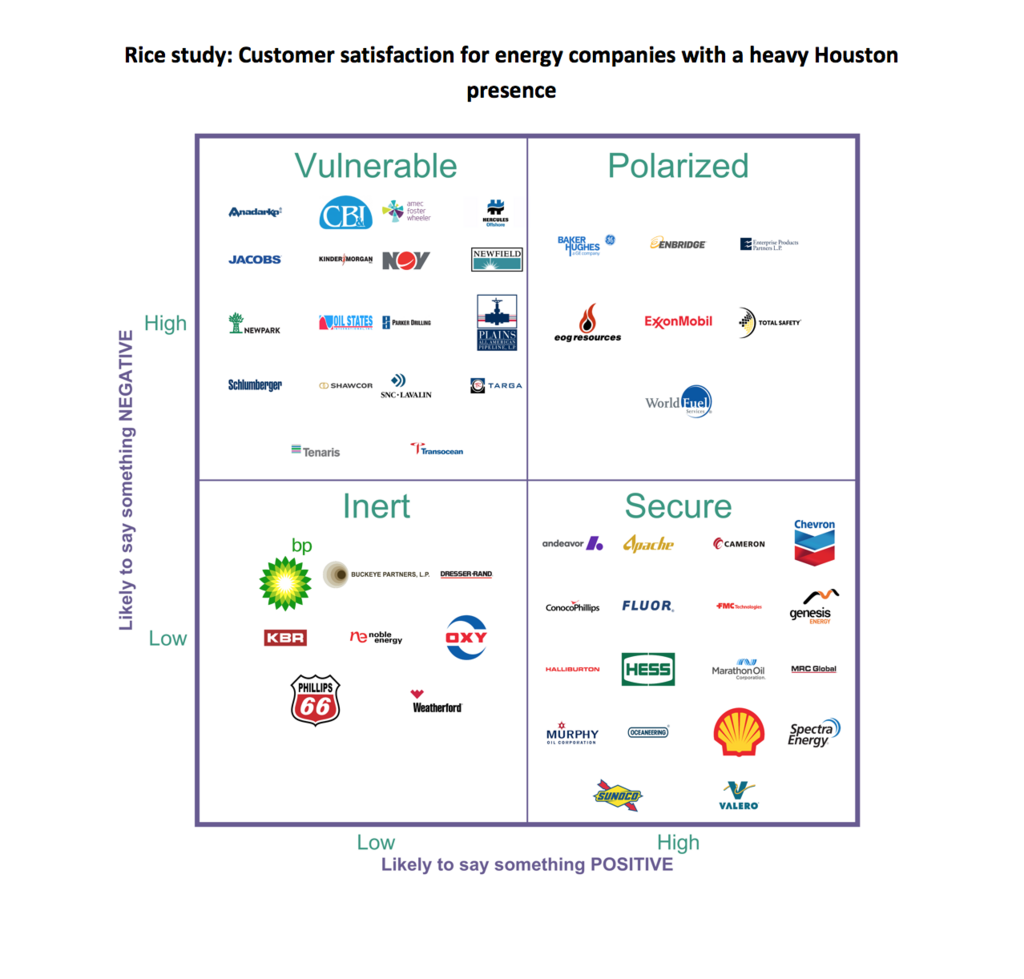

In a recent study, Rice asked 1,219 U.S. managers in the oil and gas industry with a heavy Houston presence to rate their likelihood to engage in positive and negative word-of-mouth for 51 energy brands. Based on the responses, brands were deemed either secure, vulnerable, polarized or inert.

Rice asked managers in the oil and gas industry to rate how likely they were to engage in positive or negative word-of-mouth for 51 energy brands. Source: The Collaborative for Customer‐Based Execution and Strategy’s 2017 Energy Benchmark Study

Secure: Brands with a higher-than-average percentage of customers likely to engage in positive word-of-mouth

Vulnerable: Brands with customers more likely to say negative things

Polarized: Brands with customers equally likely to engage in positive and negative word-of-mouth

Inert: Brands with customers unlikely to say anything positive or negative

The results show that 35 percent of the brands studied were vulnerable, 35 percent were secure and 16 percent were polarized. This analysis can help companies predict sales growth.

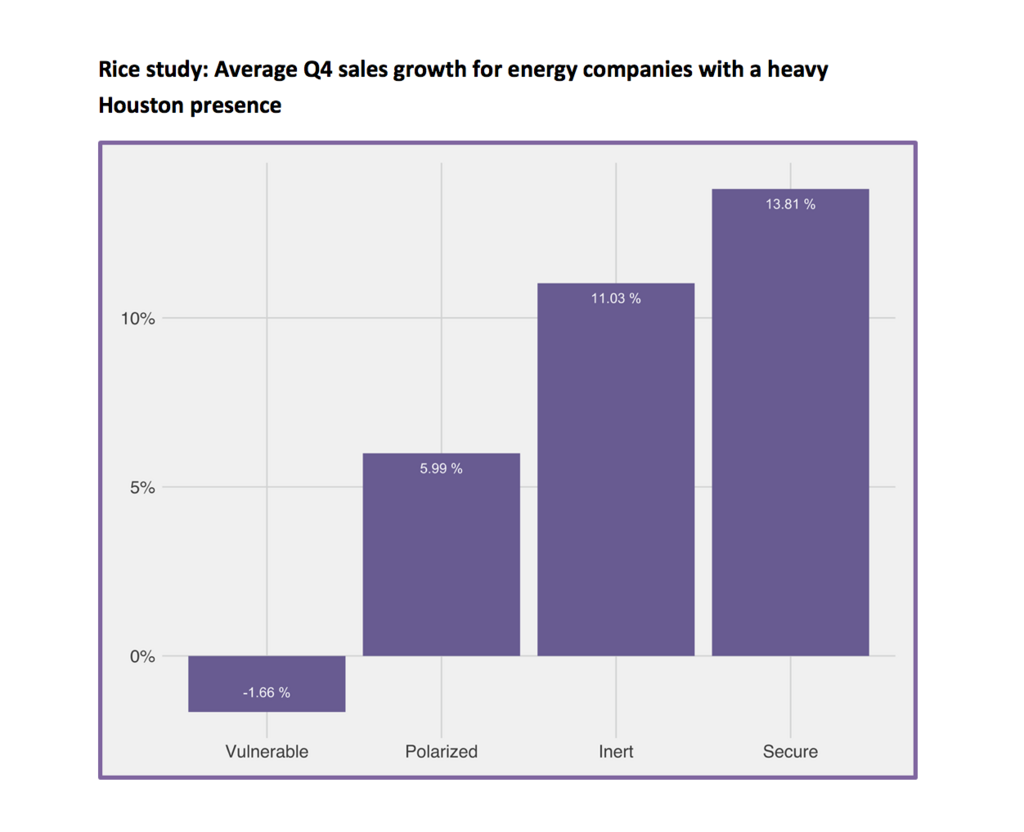

Among the 31 companies for which sales data was available, we found that secure brands had by far the highest quarterly sales growth rate in the fourth quarter of 2017, at 13.81 percent. Vulnerable brands, on the other hand, showed a sales decline of nearly 2 percent for the quarter.

Among the 31 companies for which we could access sales data, we found that secure brands had by far the highest quarterly sales growth rate in the fourth quarter of 2017, at 13.81 percent. Source: The Collaborative for Customer‐Based Execution and Strategy’s 2017 Energy Benchmark Study

At roughly 6 percent, polarized brands had less than half the sales-growth rate of secure brands. Secure companies poised for higher growth include Fluor, ConocoPhillips, Apache Corp., Oceaneering and TechnipFMC.

Judging by customer response, companies such as National Oilwell Varco, Jacobs, Tenaris, and Kinder Morgan are vulnerable and should focus on improving customer satisfaction. Polarized companies such as Enbridge and EOG Resources need to focus on eliminating negative word-of-mouth by addressing factors that cause dissatisfaction among customers.

Simply increasing positive-word-of mouth without mitigating dissatisfaction can only hurt polarized brands.

The lesson is that the customer voice is a powerful diagnostic that can help evaluate a company’s competitive position. If companies in the oil and gas industry ignore it, and focus instead on technology, they do so at their own peril.

This guest article was written by Vikas Mittal, Shrihari Sridhar, Ashwin Malshe and Kyuhong Han. Mittal is marketing professor at the Jones Graduate School of Business at Rice University, Sridhar is a marketing professor at Texas A&M’s Mays College of Business, Malshe is an assistant professor of marketing at The University of Texas at San Antonio, and Han is a Ph.D. candidate in marketing at Rice’s Jones Graduate School of Business.